colorado springs sales tax calculator

307 Sales and Use Tax Return. All PPRTA is due if the address is located in El Paso County cities of Colorado Springs Manitou Springs Ramah Green Mountain Falls and.

Sales Tax Information Colorado Springs

Method to calculate Colorado Springs sales tax in 2021.

. The Colorado sales tax rate is currently. Colorado Springs in Colorado has a tax rate of 825 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Colorado Springs totaling 535. Real property tax on median home.

With local taxes the total sales tax rate is between 2900 and 11200. Local tax rates in colorado range from 0 to 83 making the sales tax range in colorado 29. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

January 1 2016 through December 31. 307 Sales and Use Tax Return in Spanish. It also contains contact information for all self-collected jurisdictions.

Just enter the five-digit zip. Instructions for City of Colorado Springs Sales andor Use Tax Return. On November 3 2015 Colorado Springs voters approved a sales and use tax rate increase of 062 to fund road repair maintenance and improvements.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. However as anyone who has spent time in Denver Boulder or. Sales Tax Calculator Sales Tax Table The state sales tax rate in Colorado is 2900.

Colorado has a 29 statewide sales tax rate but. Colorado Sales Tax. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

The current total local sales tax rate in Colorado Springs CO is 8200. Rates are expressed in mills which are equal to 1 for every 1000 of property value. Visit the COVID-19 Sales Tax Relief web page for more information and filing instructions.

Colorado springs sales tax calculator. As we all know there are different sales tax rates from state to city to your area and everything combined is the required. This is the total of state county and city sales tax rates.

Sales Tax State Local Sales Tax on Food. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. Integrate Vertex seamlessly to the systems you already use.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. The December 2020 total local sales tax rate was 8250. This document lists the sales and use tax rates for all Colorado cities counties and special districts.

The statewide sales tax in Colorado is just 290 lowest among states with a sales tax. Companies doing business in Colorado need to register. Integrate Vertex seamlessly to the systems you already use.

The Colorado CO state sales tax rate is currently 29. The 062 road repair. Depending on local municipalities the total tax rate can be as high as 112.

This is the total of state county and city sales tax rates.

Bankerbhai Expense Inflation Calculator Investment Finance Homeloan Loan Personalloan Fridayfeeling Exitpol Business Tax Financial Planning Tax Prep

How To Calculate Cannabis Taxes At Your Dispensary

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Calculator And Coins Payroll Taxes Income Tax Preparation Business Tax

Texas Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

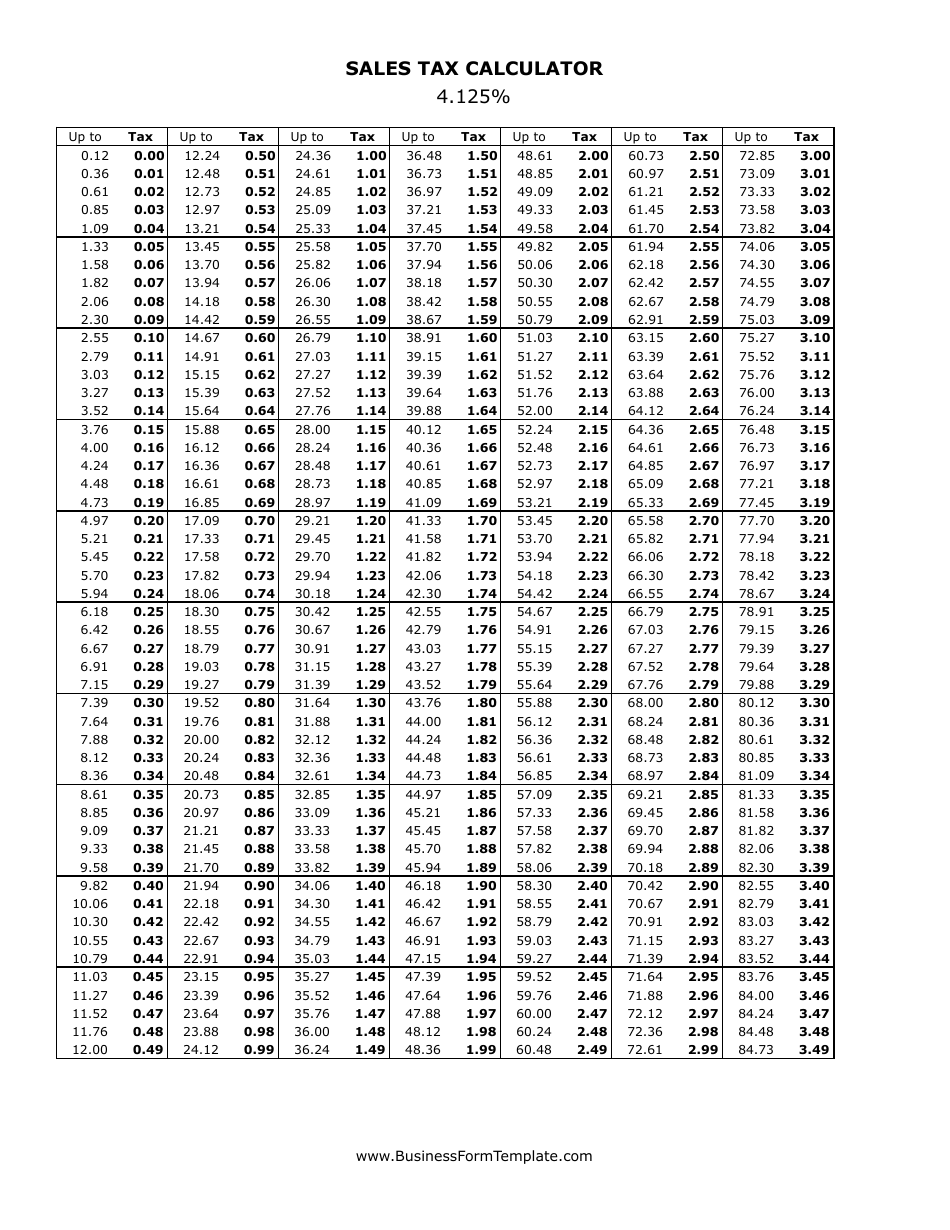

4 125 Sales Tax Calculator Download Printable Pdf Templateroller

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

How Colorado Taxes Work Auto Dealers Dealr Tax

Wyoming Sales Tax Small Business Guide Truic

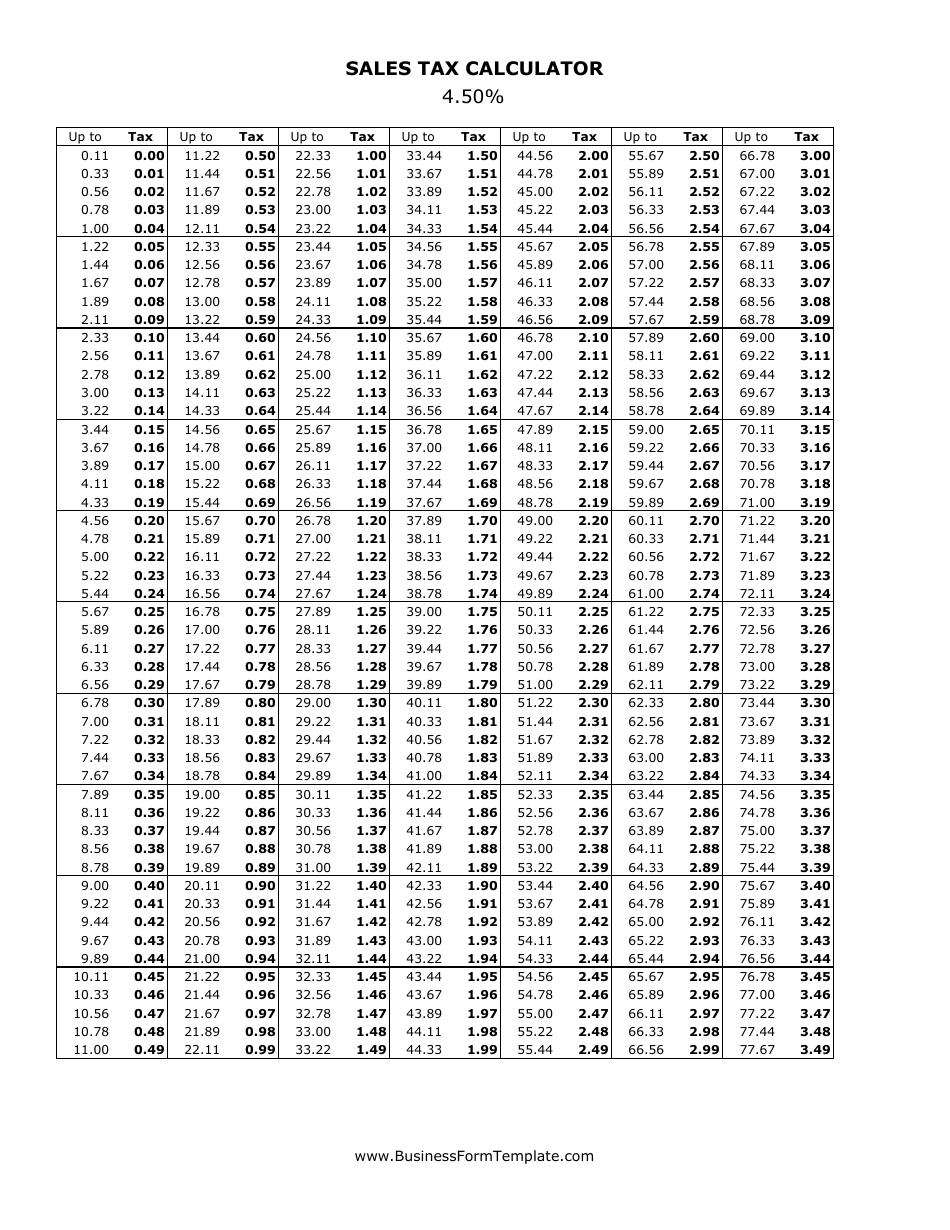

4 5 Sales Tax Calculator Download Printable Pdf Templateroller

4 5 Sales Tax Calculator Download Printable Pdf Templateroller